Goods And Services Tax Act 2017 Ppt

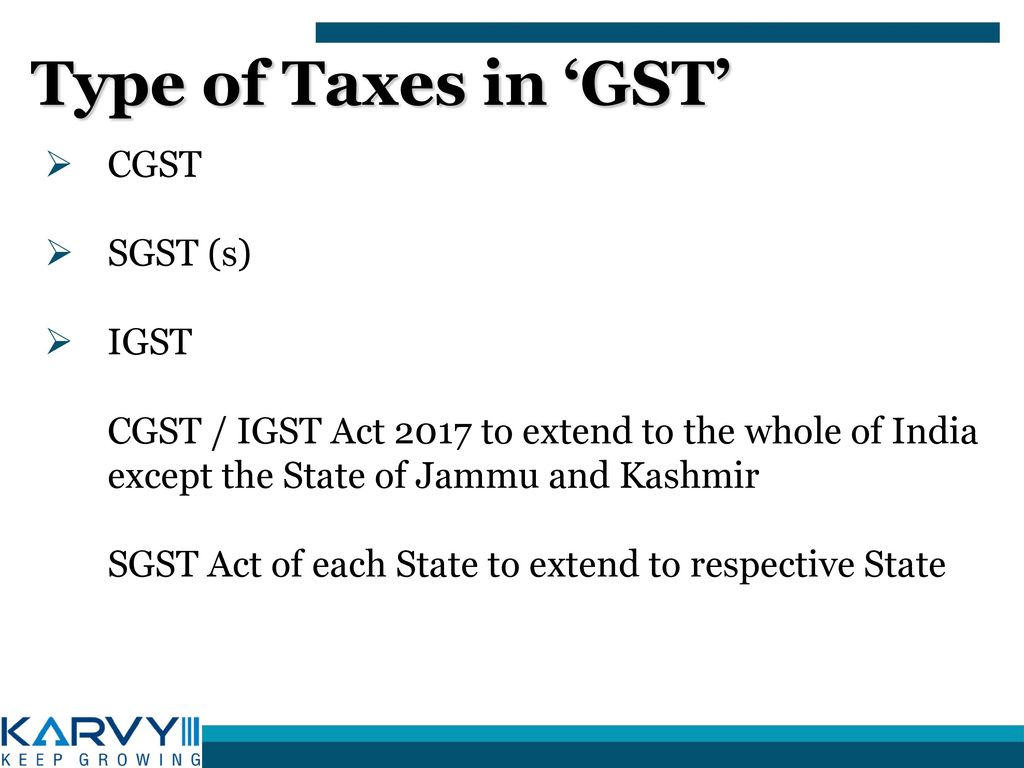

2 it extends to the whole of india except the state of jammu and kashmir.

Goods and services tax act 2017 ppt. This act or under the integrated goods and services tax act. Maharashtra goods and services tax act 2017. Exemption from registration in cgst act 2017 a exclusive supply of exempted goods services b agriculturist. As per section 22 of cgst act 2017.

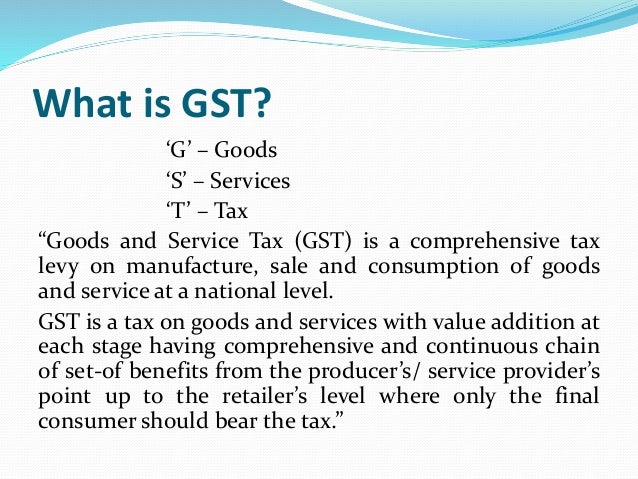

Chapter iii of central goods and services tax act 2017 integrated goods and services tax act 2017 contains the provision of levy and collection of gst. Every supplier shall be liable to be registered in the state from where he makes taxable supply of goods services both. It may be published by september 2019. The central goods and services tax act 2017 no.

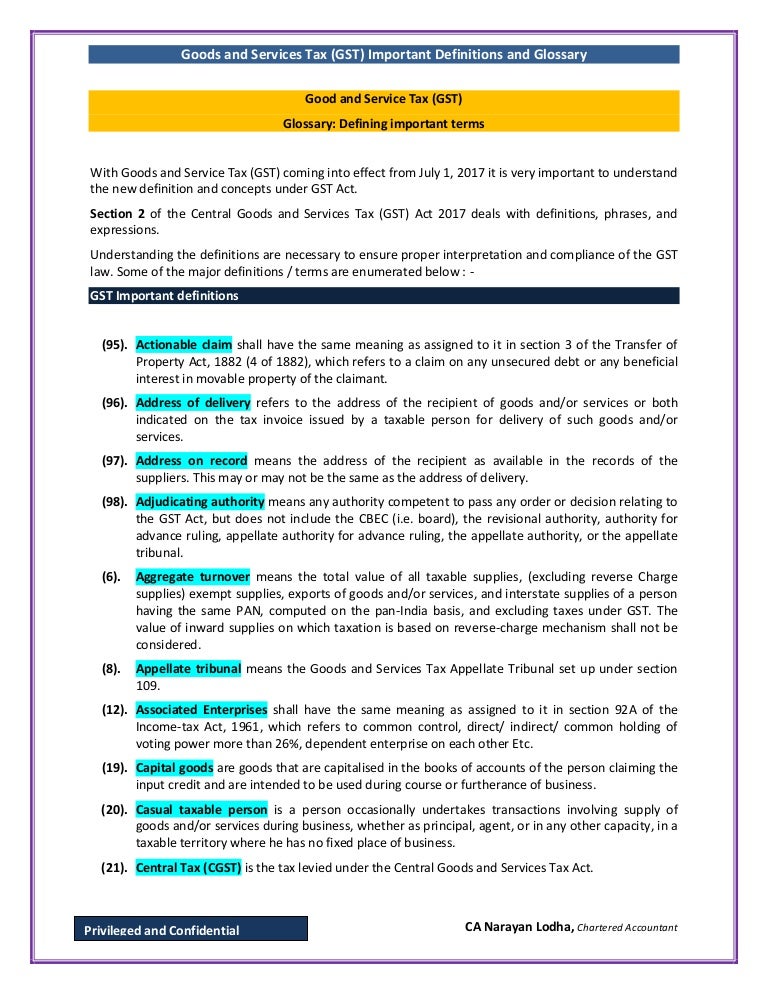

2 the government may on the recommendations of the council by notification specify the category of persons who may be exempted from obtaining registration under this act. Mgst marathi as available on the website of maharashtra vidhan mandal list of dealers in phase 1 to 17 of gst enrollment v 0 1. For definition of associated enterprises under section 92a of the income tax act 1961 see appendix. Gst is expected be levied only at the destination point and not at various points from manufacturing to retail outlets.

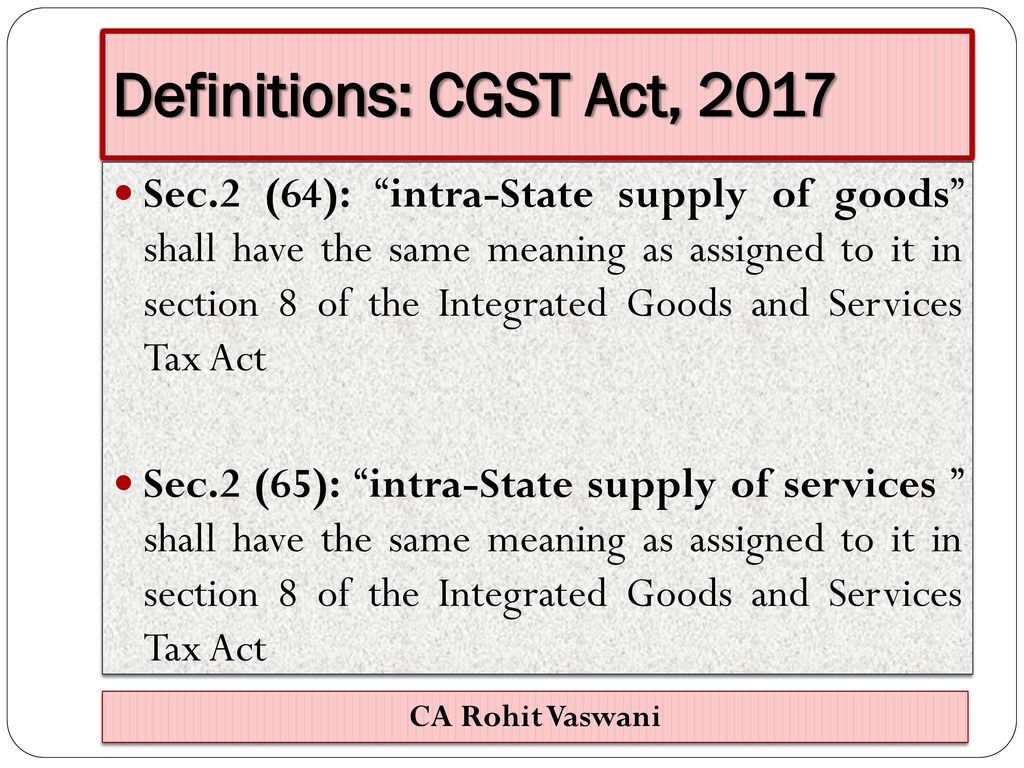

Supply includes all forms of supply of goods services such as sale transfer barter exchange licence rental lease disposal for consideration in course or furtherance of business. Be it enacted by parliament in the sixty eighth year of the republic of. Integrated goods and services tax act 2017. Short title extent and commencement.

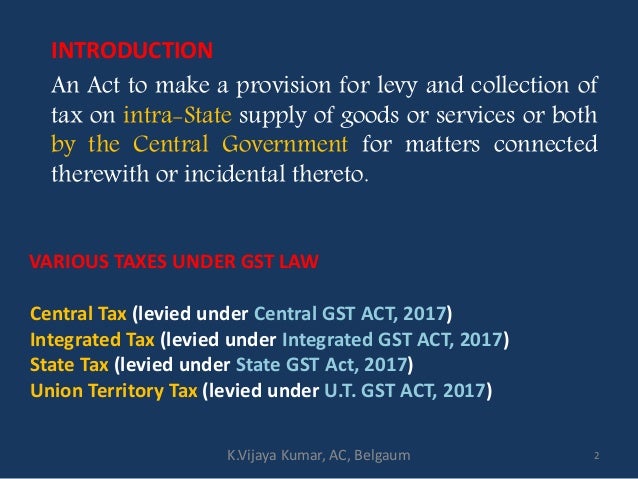

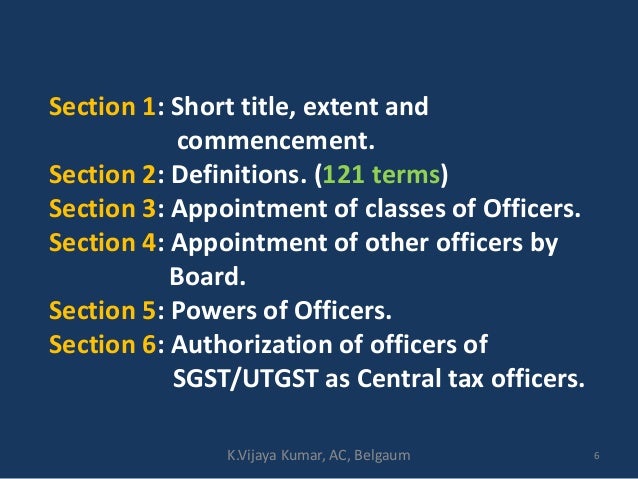

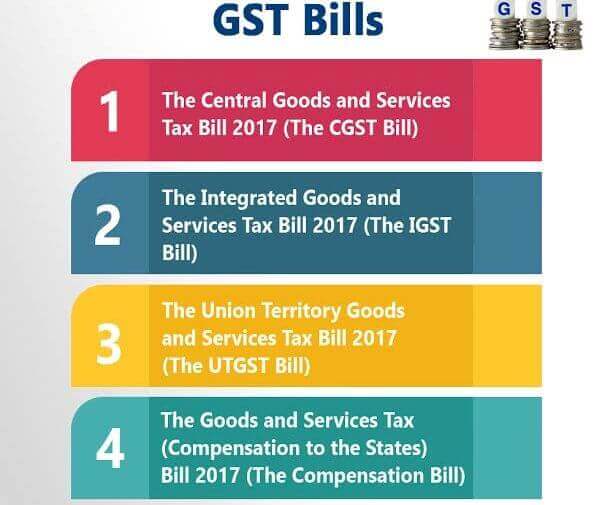

2 13 central goods and services tax act 2017 1540 1. Section 43a of central goods services tax act 2017 the section has been passed by the parliament in by january and has been implemented from 1st february 2019. 1 this act may be called the central goods and services tax act 2017. 12 of 2017 12th april 2017 an act to make a provision for levy and collection of tax on intra state supply of goods or services or both by the central government and for matters connected therewith or incidental thereto.

Clause 119 of section 2 of the central goods and services tax act 2017 provided by a sub contractor to the main contractor providing services specified in item iii or item vi above to the central government state government union territory a local authority a governmental authority or a government entity. Goods and services tax compensation to states act 2017. Paid refund claimed and input tax credit availed and to assess his compliance with the provisions of this act or the rules made there. The implementation notification is not published yet.