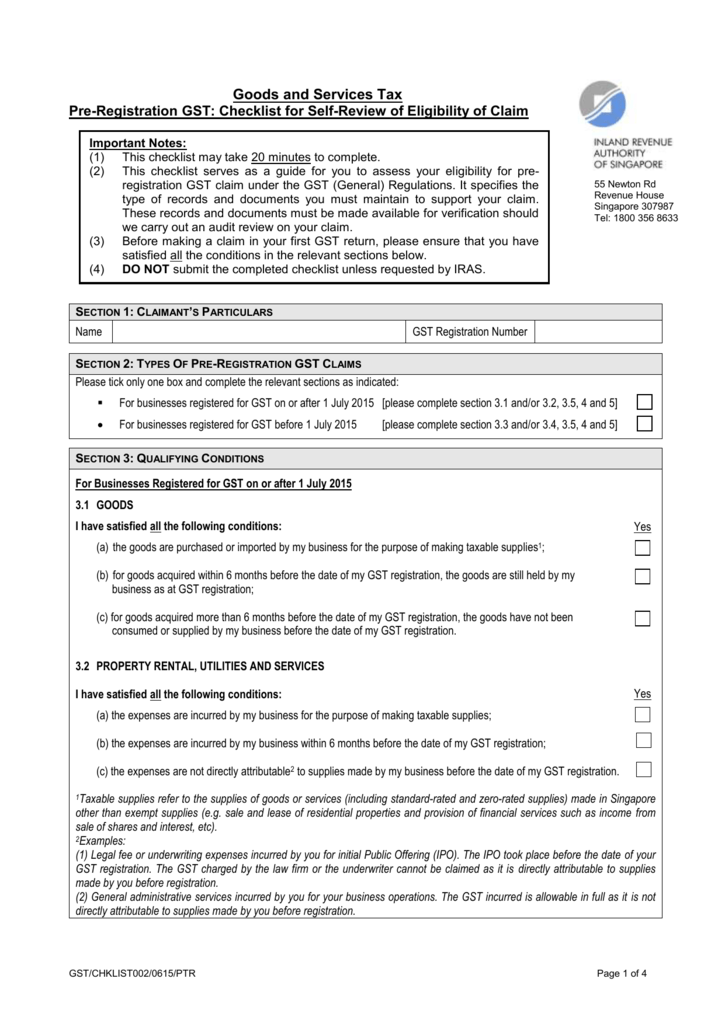

Goods And Services Tax Gst Registration

You can register for goods and services tax gst online by phone or through your registered tax or bas agent when you first register your business or at any later time.

Goods and services tax gst registration. Apa apa permohonan rayuan cbp. It applies to all indian services providers like traders manufacturers. You pay this to the australian taxation office ato when it s due. Gst exemptions apply to the provision of most financial services the supply of digital payment tokens the sale and lease of residential.

Attention please be informed that this portal will remain active until further notice. This is called standard gst registration. Your non profit business or organisation has an annual gst turnover of 150 000 or more. Goods and services tax gst is a tax of 10 on most goods services and other items sold or consumed in australia.

You must first be authorised in corppass by the business to be able to access the gst registration e service on mytax portal. Three steps to understanding gst step 1 a gst registered business eg. You only need to register for gst once even if you operate more than one business. You receive fares for transporting passengers by taxi or limousine e g.

In other countries gst is known as the value added tax or vat. Goods services tax gst was launched on 1 july 2017. A retailer purchasing goods and services for the business will pay the supplier of those goods gst of 10 if the supplier is registered for gst. Your business or organisation has an annual gst turnover of 75 000 or more.

Not just that but a variety of schemes have also been introduced by the singapore regime to reduce the gst filing burden of businesses. If your business is registered for gst you have to collect this extra money one eleventh of the sale price from your customers. Gst is imposed at a rate of 10 of the value of the goods and services sold or goods imported. The goods and services tax gst of singapore which stands at 7 is arguably one of the lowest when compared to the other asian countries.

Goods and services tax or gst is a broad based consumption tax levied on the import of goods collected by singapore customs as well as nearly all supplies of goods and services in singapore. Central goods and services tax or cgst state goods and services tax or sgst. Gst is to be charged at every step of the supply chain with full set off benefits available. You are required to register for goods and services tax gst if either.

The authorisation can be for access to any of iras e services e g.