Input Tax Credit Rules Under Gst Pdf

Input tax credit 63 75.

Input tax credit rules under gst pdf. Eligibility and conditions for taking input tax credit 64 17. Cascading of taxes in simple language is tax on tax. How itc can be claimed by job worker. Definition of input input service capital goods.

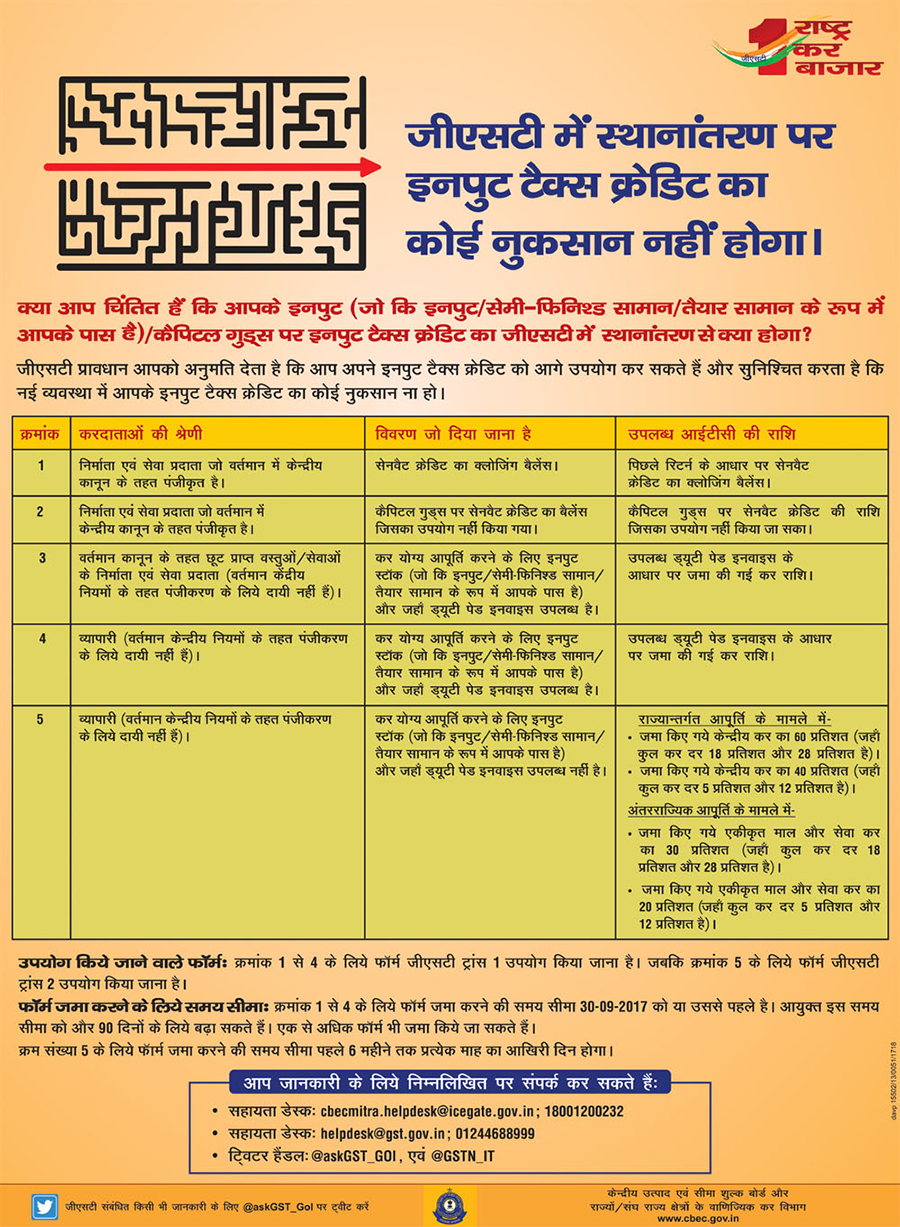

What is input tax. For complete details law rules notifications and other information. Download gst input tax credit rules gst. Input tax credit itc under gst directorate of commercial taxes west bengal note.

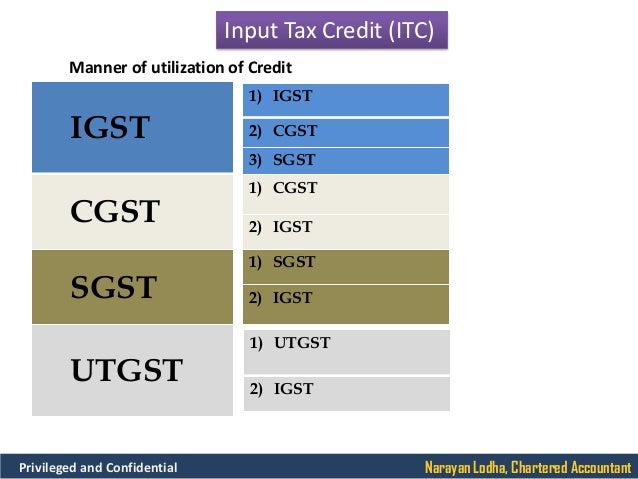

Taking input tax credit in respect of inputs and capital goods sent for job work 73 20. 01 01 2020 of the eligible credit available in respect of invoices or debit. What do you mean by business in gst. Input tax credit mechanism in gst uninterrupted and seamless chain of input tax credit hereinafter referred to as itc is one of the key features of goods and services tax.

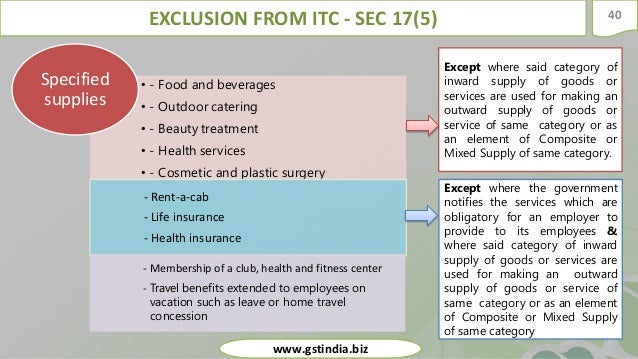

Under the present system of taxation credit of. Availability of credit in special circumstances 71 19. Reference to wbgst act 2017 includes reference to cgst act 2017 also. Apportionment of credit and blocked credits 66 18.

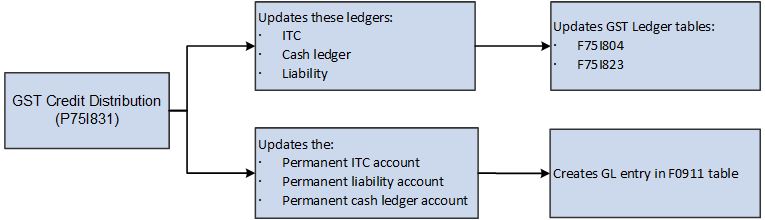

Ne of the much talked about feature of goods and services tax act gst is seamless input tax credit. Input tax credit. 1 documentary requirements and conditions for claiming input tax credit 2 reversal of input tax credit in case of non payment of consideration 3 procedure for distribution of input tax credit by input service distributor 4 manner of determination of input tax credit in respect of capital goods and reversal thereof in certain cases 5 conditions. What is input tax credit.

Cma bibhudatta sarangi dgm f a. This credit mechanism ensures. 1 2 you should read this e tax guide if you are a partially exempt business that is you make both taxable supplies and exempt supplies2. Who should read this e tax guide.

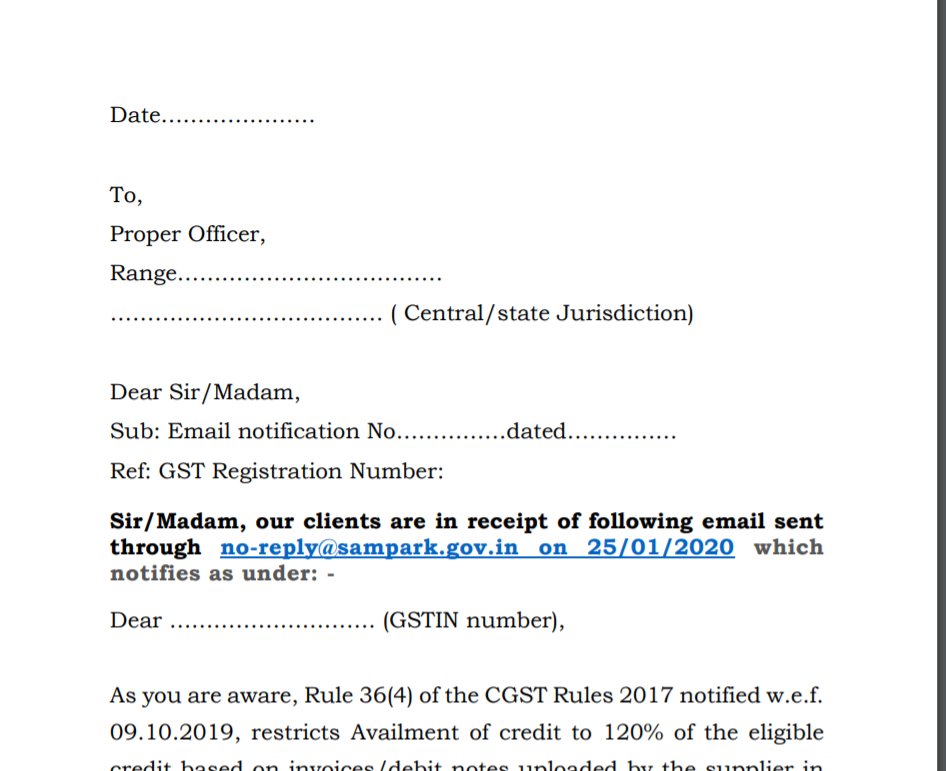

Goods under the provisions of the income tax act 1961 the input tax credit shall not be allowed on the said tax component. How itc can be claimed by banking and financial. Section 16 to section 21 of the gst act 2017 passed on 12th april 2017 comprehensively discuss the provisions relating to the input tax credit. Input tax credit to be availed by a registered person in respect of invoices or debit notes the details of which have not been uploaded by the suppliers under sub section 1 of section 37 shall not exceed 10 per cent w e f.

Answer is only for educational and guidance purposes and do not hold any legal validity. Input tax is the gst that businesses incurred on their purchases from gst registered suppliers or when they import goods into singapore. What is the time period to avail itc. Partial exemption and input tax recovery 1 1 aim scope of this e tax guide 1 1 this e tax guide explains the partial exemption rules and input tax recovery rules 1.

Itc is a mechanism to avoid cascading of taxes.