Input Tax Credit Rules Under Gst Time Limit

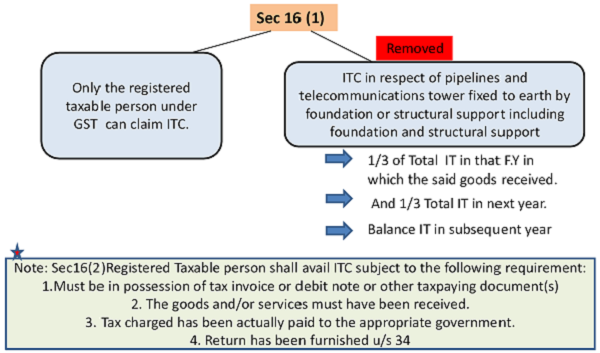

All registered person are allowed to take input tax credit other than person who are paying tax under composition scheme.

Input tax credit rules under gst time limit. Input credit helps in determining the correct amount of working capital at any given point of time. There are different situations wherein the inputs can be claimed for semi finished goods or stock or finished goods. A person who has applied for registration within 30 days from the date on which he is liable for registration is allowed to take input tax credit in respect of inputs held in stock and inputs contained in semi finished or. In the above example mk kitchen knives has a total input tax credit of rs 80 000 rs 50 000 rs 30 000 from both cgst and sgst.

As per section 18 2 of cgst act a taxable person is not entitled to take input tax credit in respect of any supply of goods and or services to such person after the expiry of 1 year from the invoice date relating to such supply. Goods and services tax gst is considered the biggest reforms in india. Persons who are allowed to take input tax credit. Note that as per circular no.

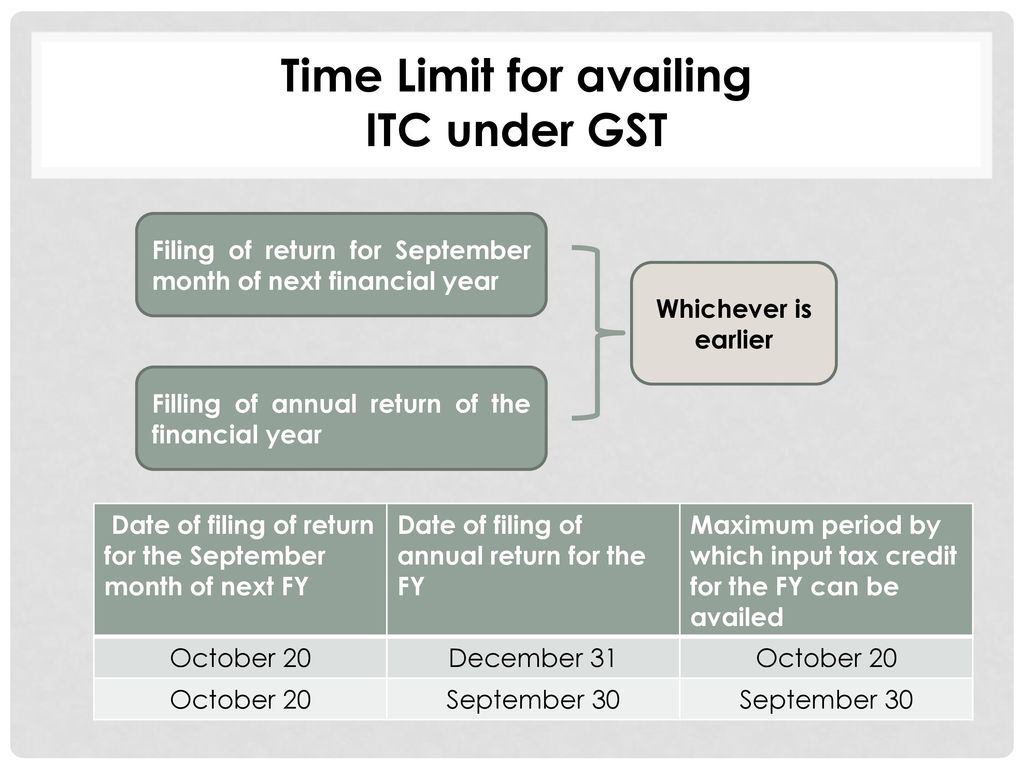

Itc can be availed by a registered taxable person in a specific manner and within a specified time frame. This is highly critical information from business liquidity standpoint. However as per the provisions of section 16 3 the input tax credit on the said tax component shall not be allowed if the registered person has claimed depreciation on the tax component of the cost of capital goods under the provisions of the income tax act of 1961. In simple words input credit means at the time of paying tax on sales you can reduce the tax you have already paid on purchases.

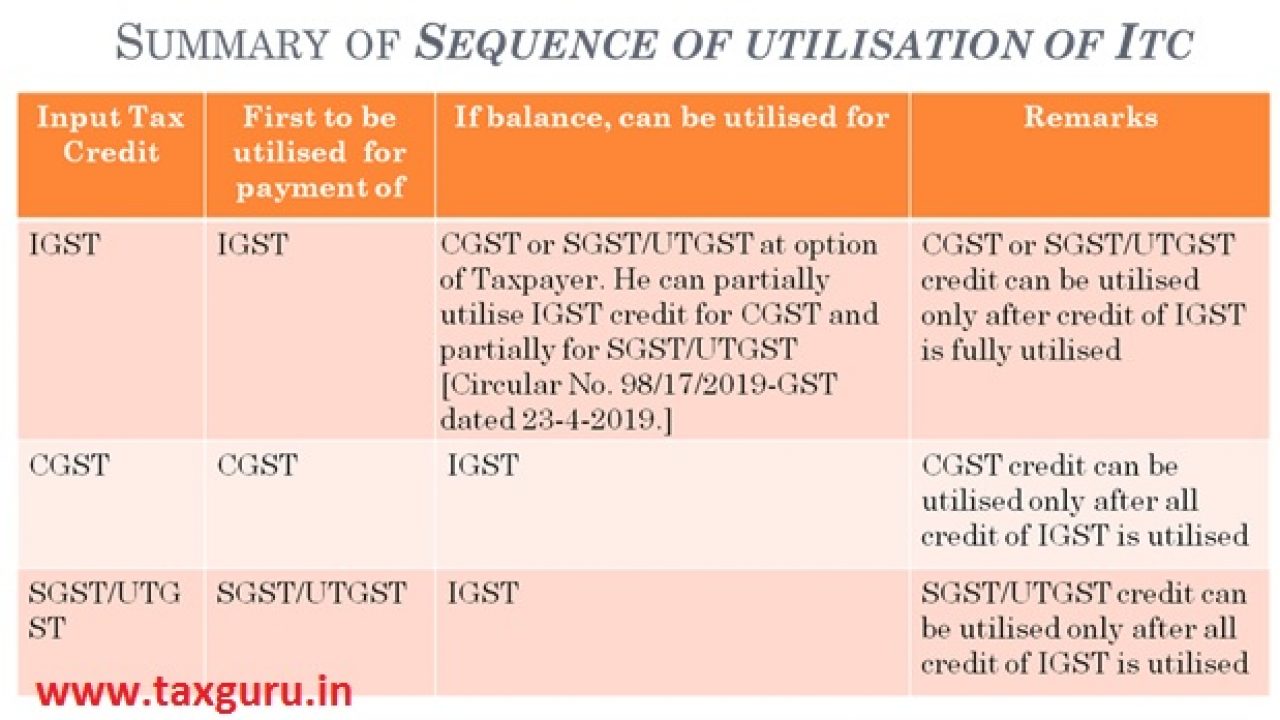

98 17 2019 gst dated 23rd april 2019 the common portal currently supports the order of utilization of input tax credit in accordance with the provisions before implementation of the provisions of the cgst amendment act i e. Please note time limit u s 16 4 does not apply to claims for re availing of credit that has been reversed earlier. Period prior to 1 2 2019. The concept of time limit was also introduced in the cenvat credit rules.

In the gst era section 16 4 of the cgst act provides for a time limit by which itc should be claimed. Based on the tax offsetting rules under gst they use the cgst input tax credit worth rs 80 000 to offset the cgst liability of rs 87 000 rs 47 000 rs 40 000 once this adjustment is completed the remaining cgst liability is rs 7 000 rs 87 000 rs 80 000. The time limit to avail gst itc. Since dual benefits cannot be awarded to the taxpayer under both the gst laws and the income tax act simultaneous the benefit.

Pre insertion of section 49a and section 49b of the cgst act i e. Time limit is mandatory. Section 19 11 of the tamil nadu vat act provided for a time limit to avail input tax credit. However one thing that has become the talking point is the mechanism of input credit under gst.