Input Tax Credit Under Gst With Example In Hindi

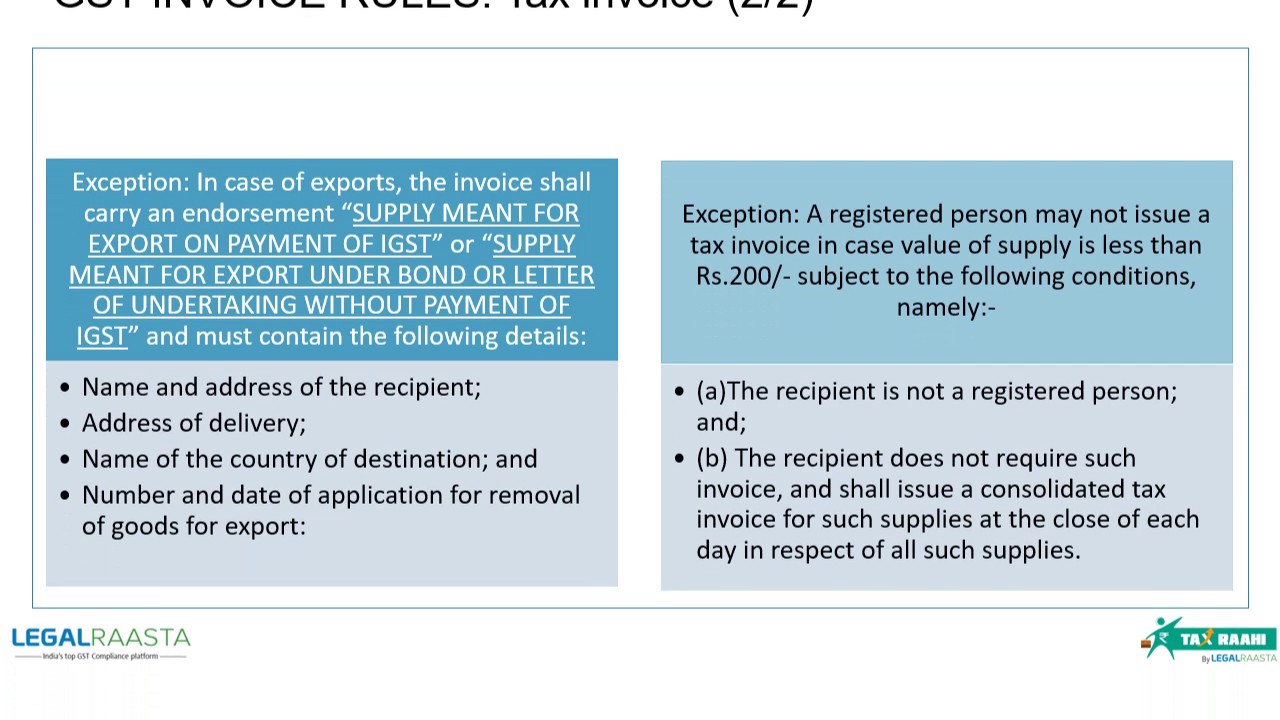

A registered dealer can claim input tax credit on the basis of following documents 1 a tax invoice issued by registered supplier 2 a debit note issued in respect of earlier issued tax invoice by the registered supplier 3 an invoice issued by the recipient of goods or services who has paid tax under reverse charge mechanism 4 a bill of entry or similar document in case of imports.

Input tax credit under gst with example in hindi. C of punjab at inr 1500. B of gujarat at inr 1000. Since it is an inter state sale igst would be charged say 5 i e. Illustrations of input tax credit under gst.

B will able to avail input tax credit of inr 50. You can claim input tax incurred when you satisfy all of the conditions for making such a claim. B of gujarat sells the above goods to mr. When purchasing from gst registered suppliers or importing goods into singapore you may have incurred gst input tax.

You must make your claim during the accounting period that matches the date shown in the tax invoice or import permit. Business news in hindi gst input tax credit invoice gst rates. A of maharashtra sells goods to mr.