Payment Liable For Socso Contribution

However the following payments are not considered as wages.

Payment liable for socso contribution. Many of us used to use iperkeso to pay socso. Ilpc is charged for late payment of contributions at the rate of 6 percent per annum for each day of late payment contributions. 0 2 will be paid by the employer while 0 2 will be deducted from the employee s monthly salary. The payments below are not considered wages and are not included in the calculations for monthly deductions.

All payments made to an employee paid at an hourly rate daily rate weekly rate piece or task rate is considered as wages. Wages not subject to socso contribution. Then the total amount is the addition of these two and will go towards the socso fund. Commissions and service charges.

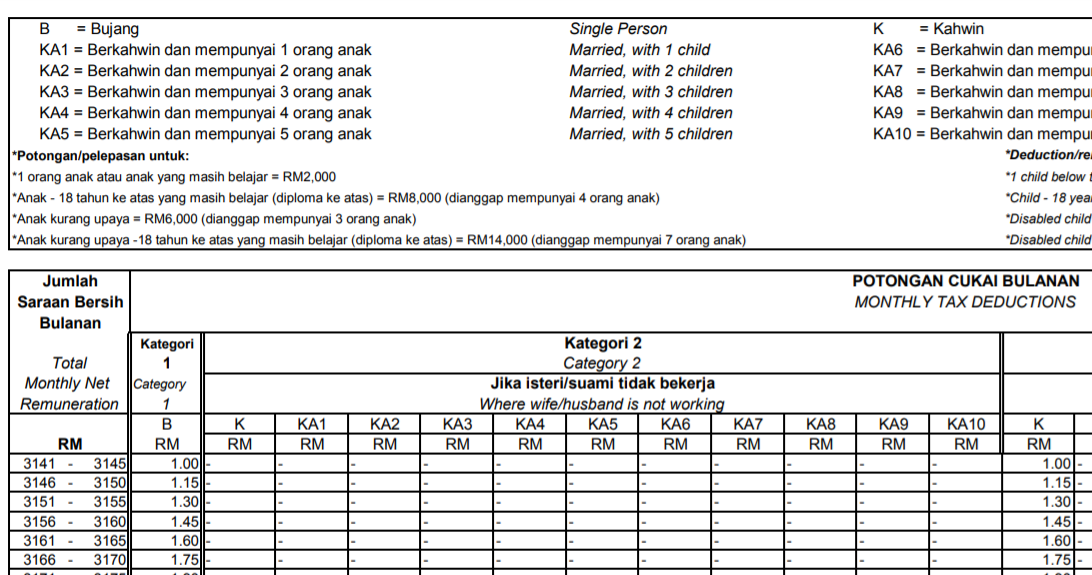

Socso malaysia 2020 monthly benefit payment rate s contributions for eis table contributions to the employment insurance system eis are set at 0 4 of the employee s assumed monthly salary. Additional work days on holidays and overtime. Salary wages full part time monthly hourly overtime payments commission paid. No payment required refer irbm faqs no 16 10 april 2020 for company entities that is sme paid up capital less than rm2 5m and revenue less than rm50m are allowable to defer the cp204 payment due on 15 04 2020 15 05 2020 and 15 06 2020 and for other company cp500 payment due on 31 03 2020 and 31 05 2020.

Any contribution payable by the employer towards any pension or provident fund. Payments exempted from socso contribution. Types of payments that are not liable for socso contribution. In simple terms there are two categories of the socso fund.

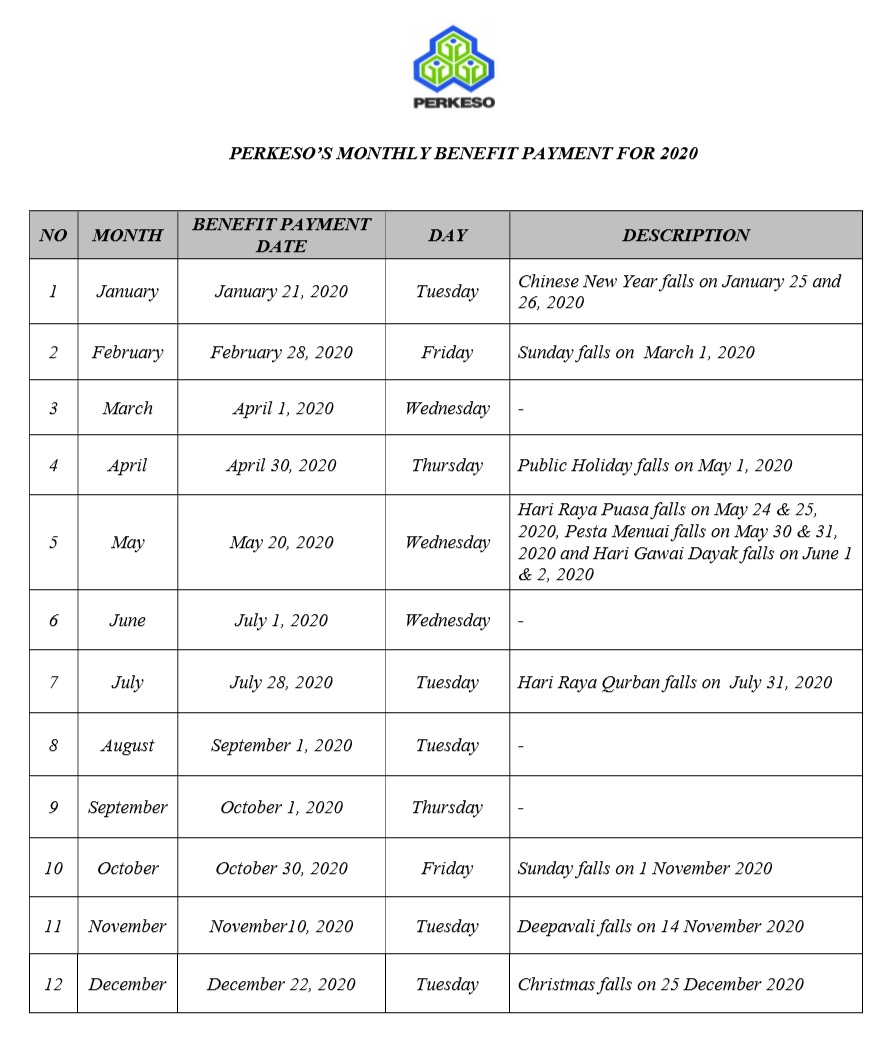

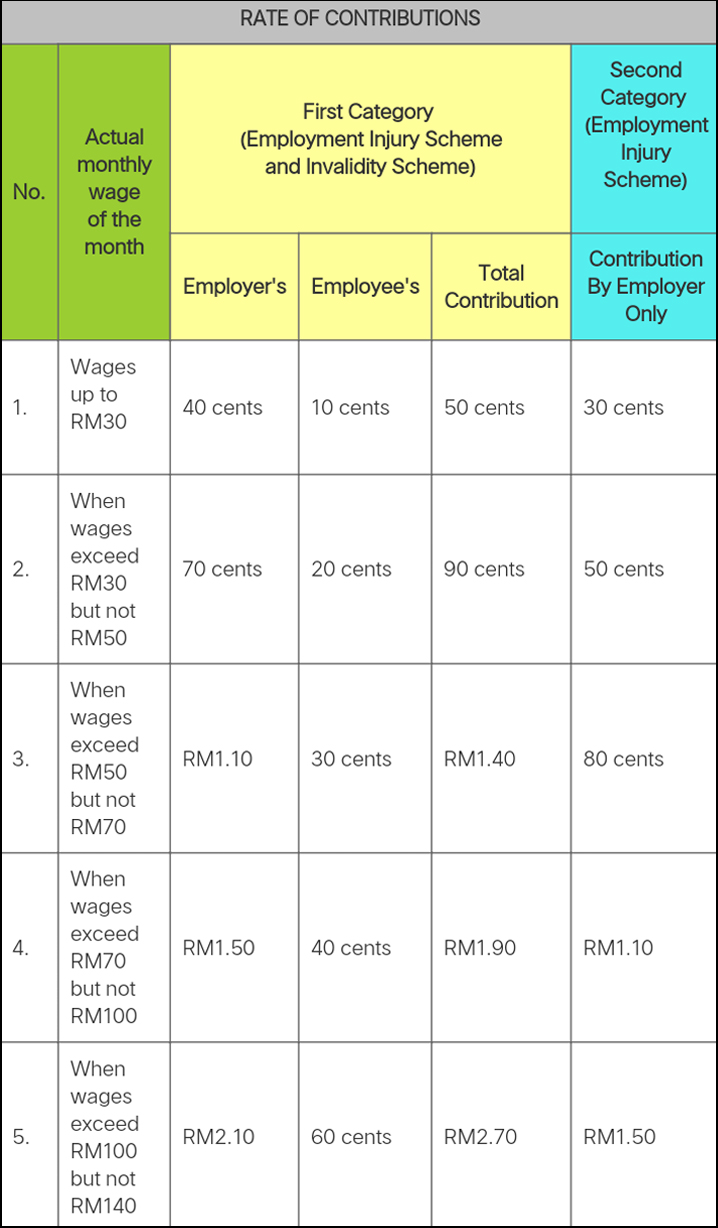

Payment of contribution rate of contribution rate of contribution for employees social security act 1969 act 4 no. For example january contributions should be paid not later than february 15. From what we heard from socso it was mentioned that they will eventually discontinue iperkeso and we should continue our payment in assist portal. If you re still paying cheque to the socso counter you should moving it to online.

Wages subject to socso contribution. The employer is liable to pay monthly contributions within 15 days of the following month. Types of income subjected to socso contribution. Incentive meal housing cost of living allowance cola shift and others.

In the first category for the most part the employer is to pay 1 75 of the employee s total salary towards the fund and the employee is to pay 0 5 of their salary amount towards the fund. How to pay socso perkeso online. Any gratuity payable on discharge or retirement of the employee. All renumeration or wages stated below and payable to staff workers are subject to socso contributions.